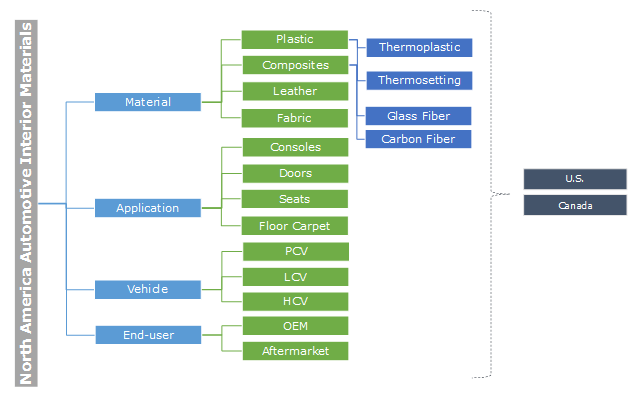

According to the Graphical Research new growth forecast report titled “North America Automotive Interior Materials Market Size, By Material (Plastic [Thermoplastic, Thermosetting], Composites [Glass Fiber, Carbon Fiber, Natural Fiber], Leathers, Fabric), By Application (Consoles & Dashboard, Doors, Seats, Steering Wheel, Floor Carpet, Others), By Vehicles (Passenger Car, LCV, HCV), Industry Analysis Report, Country Outlook, Application Potential, Price Trend, Competitive Market Share & Forecast, 2020 - 2026”, to Witness Steady Growth by 2026.

Growing stringent emission norms coupled with increasing electrification will bolster market growth. According to the U.S. Department of Energy, the plug-in vehicle sales in the U.S. grew rapidly from 195,581 units to 326,644 units in 2019. U.S and Canada have introduced several initiatives to boost plug-in hybrid and electric vehicle sales, providing an opportunistic scenario for automotive interior manufacturers. The segment demand is expected to grow owing to increasing sales of luxury vehicles. Brands such as BMW, Audi, Mercedes Benz, Porsche, and Jaguar Land Rover registered growth in terms of sales amongst the highest being registered by BMW from selling 311,014 units in 2018 to 324,826 units in 2019.

Increasing heavy vehicle sales coupled with new fleet additions, and technological progressions will drive interior material industry growth. There has been a continuous rise in the average use of plastics and composites in vehicles to reduce vehicular weight by replacing conventional heavy and high-density materials. Manufacturers are increasingly investing in material technology to improve vehicle aesthetics without compromising strength. Additionally, the North American market is majorly dominated by heavy vehicles and SUVs, conventionally using more interior material, thus boosting material demand.

Based on materials, the composites segment is amongst the fastest-growing segments in the North America interior materials market, showcasing over 7% CAGR on a volumetric basis. Continuous weight reduction efforts from manufactures to improve vehicular efficiency and performance are set to be a major demand driver for lightweight interior materials. Composite materials such as carbon fiber are typically installed in premium and high-end luxury cars owing to the high manufacturing cost of the material. However, innovative manufacturing techniques resulting in steady cost reduction have resulted in a promising outlook for the material. Carbon fiber will witness strong growth and is expected to gain share dramatically owing to superior strength to weight ratio.

In North American market application, floor carpets are one of the fastest-growing subsegments. As manufacturers strive to increase cabin comfort and offerings amidst high competition, the use of flooring carpet has increased as manufacturers are gradually squeezing more and more floor spaces inside the cabin. The use of premium and functional carpet material is also been on the rise as the region is home to high volume sales of utility vehicles.

Passenger car is the second-largest segment after LCV in North America interior materials market and is expected to showcase a CAGR of 5.5% on a revenue basis. Passenger car sales are expected to increase as the number of electric vehicles is increasing rapidly. This influx of electrified offerings from the manufacturers is set to support interior materials demand as automakers are exploring alternative cabin materials such as vegan leather and recycled plastic to support an environmental cause.

Canada will witness over 5% CAGR on a revenue basis. Government efforts to increase electric and plug-in vehicle adoption is set to increase vehicular sales in the country. Canada witnessed. Canada enjoyed a steady sales increase from 2009 to 2018 and witnessed a slight slump in demand in 2019 owing to the global slowdown. However, the region is expected to rebound with stronger sales and rebounding consumer demand supported by new releases from manufacturers.

The North America industry participants include Continental AG, UFP Technologies, SABIC, Arkema, BASF SE, EVONIK Industries AG, Hexcel Corporation, Toray Industries Inc, Huntsman International, Dow Chemical Company, Covestro, etc.